It is described as “contra” because having a credit balance in an asset account is contrary to the normal or expected debit balance. (A debit balance in a contra asset account will violate the cost principle.) Learn more about contra asset accounts. contra expense account Contra equity accounts are accounts in the equity section of the balance sheet that reduce the amount of equity a company holds. Therefore, contra equity accounts have a debit balance to offset their corresponding equity balances.

- To illustrate the contra revenue account Sales Returns and Allowances, let’s assume that Company K sells $100,000 of merchandise on credit.

- While transactions may be recorded in one or more arrangements, the typical balance is a debit, contrasting with the usual credit balance in a standard sales account.

- It is because clubbing together dissimilar transactions impedes any analysis.

- If we record depreciation expense in the cost accounts directly, we will lose key information about the original cost of the assets and accumulated depreciation.

- For example, when a line item on your balance sheet presents the balance of accounts receivable, report the value of allowance of uncollectible accounts below the accounts receivable line.

- In your income statement, the gross sales are $50,000 less than the sales returns and allowances of $1000.

What are the Different Types of Contra Accounts?

For example, a building is acquired for $20,000, that $20,000 is recorded on the general ledger while the depreciation of the building is recorded separately. Get instant access to video lessons taught by experienced investment bankers. In this article, we’re going on a deep dive into what exactly a contra account is, how contra accounts work, why and how you would use contra accounts and more. The sales allowances account contains either an allowance for reductions in the price of a product that has minor defects, or the actual amount of the allowance attributable to specific sales.

- In double entry bookkeeping terms, a contra revenue account or contra sales account refers to an account which is offset against a revenue account.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- For example, when your company borrows money, you would identify that debt in a Notes Payable account.

- And when your business still has some of these outdated, unwanted, or unusable items in your inventory, you’ll want to offset the lost value of these assets in your general ledger and balance sheet.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- In reality, the actual number of company discounts came closer to $5 thousand.

What Is a Contra Account?

This, in turn, can impact profitability and provide a better picture of a business’s financial health. Accounts receivable (A/R) has a debit balance, but the allowance for doubtful accounts carries a creditbalance. Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account.

Example of Contra Revenue in Sales Discounts

The sales discounts contra revenue account records the discounts given to customers on sales made to them, normally a cash or settlement discount. The account is normally a debit balance and in use is offset against the revenue account which is normally a credit balance. Consequently the net balance of the two accounts shows the net value of the sales after discounts. In response, the firm should decrease its accounts receivable and revenue balances.

That is done by crediting accounts receivable by $100 and debiting the contra revenue account sales returns and allowances for $100. Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation. When a company gives a discount to customers in an effort to convince them to buy its goods or services, it is recorded in the discount on sales account.

- Contra accounts such as these have a debit balance and are deducted from the total amount of a company’s revenue.

- If a company sells a bond at a discount, the difference between the cash received and the value of the bond it sold will be listed as “discount on bonds payable,” which is a contra liability account, the counterpart of bonds payable.

- But sometimes, dissimilar transactions are important to consider together within a ledger.

- A contra asset account is an asset account where the account balance is a credit balance.

- In this way, the historical cost, the amount of write-off, and the book value of an asset can always be seen on the balance sheet.

What Are Examples of a Contra Asset Account?

For example, it is not very useful to show the PPE cost account and the related accumulated depreciation account separately on the balance sheet. We are better off subtracting the accumulated depreciation account (the contra account) from PPE cost account (the parent account) to arrive at the net balance of the PPE. For instance, if a company has a plant asset such as Equipment with a debit balance of $92,000 and the account Accumulated Depreciation has a credit balance of $50,000, the carrying amount (or book value) of the equipment is $42,000. These less-frequent contra accounts come into play when you need to account for changes in the outstanding liabilities for your business. For example, when your company borrows money, you would identify that debt in a Notes Payable account.

- GAAP, the allowance for doubtful accounts represents management’s estimate of the percentage of “uncollectible” accounts receivable (i.e. the credit purchases from customers that are not expected to be paid).

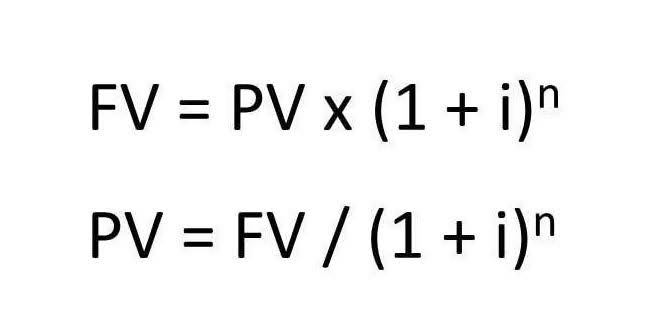

- Therefore, the book value of an asset in the books is equal to its historical cost (the debit balance of the asset) minus the related amount of contra asset in the balance sheet (the credit balance of the contra asset).

- The purpose of the Accumulated Depreciation account is to track the reduction in the value of the asset while preserving the historical cost of the asset.

- Again, the company’s management will see the original amount of sales, the sales discounts, and the resulting net sales.

- Examples of contra assets include Accumulated Depreciation and Allowance for Doubtful Accounts.

How to Record a Contra Account