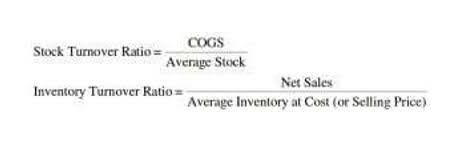

By comprehending the definition, recognizing the importance, and understanding the purposes of the operating cycle, businesses can make informed financial decisions and work towards optimizing this critical aspect of their operations. For example, an efficient sales force can increase the company’s market share and reduce the time it takes to acquire new customers. Also, high inventory turnover can reflect a company’s efficient operations, which in turn lead to increased shareholder value. An efficient operational process can also help reduce other costs like marketing, finance, etc.

Operating Cycle Formula

Hence, the cash conversion cycle is used interchangeably with the term “net operating cycle”. The Operating Cycle tracks the number of days between the initial date of inventory purchase and the receipt of cash payment from customer credit purchases. The companies with high operational efficiency are typically those that provide goods or services with short shelf lives i.e., clothing, electronics, etc.

- We’ll now move to a modeling exercise, which you can access by filling out the form below.

- By optimizing the operation cycle, a company can greatly improve its cash management and decrease costs.

- If a company is a reseller, then the operating cycle does not include any time for production – it is simply the date from the initial cash outlay to the date of cash receipt from the customer.

- To gain a deeper understanding of how operating cycle management can impact businesses, let’s explore a couple of real-world examples and case studies that highlight the significance of this financial concept.

- Upgrade to one of our premium templates when needed and take your work to the next level.

- It’s previous time to deployment took approximately 15 months, and a large proportion of models failed to be used in production because of the long delivery time across business lines.

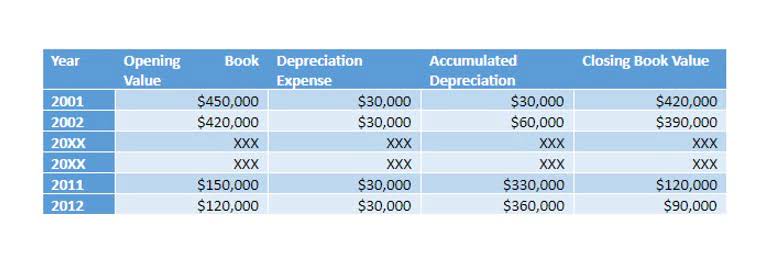

Days Sales Outstanding (DSO)

This process begins with a road map and communication, including an understanding of pain points and an estimation of the baseline efforts, such as metrics, cycle times, supporting infrastructure, and workflow management tools. For example, a company might have 60-day terms for money owed to their supplier, which results in requiring their customers to pay within a 30-day term. Current liabilities can also be settled by creating a new current liability, such as a new short-term debt obligation. Every industry works differently, which means that the length of this operating cycle can vary from one niche to another. Understanding your operating cycle can help you determine your financial health as it can give you a great indication of the company’s ability to pay off its liabilities in due course. For instance a retailer’s operating cycle would be the time between buying merchandise inventory and selling the same inventory.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- A leading US bank launched a model life cycle transformation initiative to accelerate model delivery and enhance the analytical capability.

- By implementing these best practices, you can significantly reduce your Days Sales Outstanding (DSO) and expedite the cash collection process, thereby shortening your operating cycle and enhancing your financial stability.

- While it is a good for the company’s shareholders that the company is keeping its working capital low, they need to make sure that the very long days payable outstanding is not due to any liquidity problem.

- This is calculated by dividing 365 with the quotient of cost of goods sold and average inventory or inventory turnover.

- If a company is able to keep a short operating cycle, its cash flow will consistent and the company won’t have problems paying current liabilities.

- In this sense, the operating cycle provides information about a company’s liquidity and solvency.

How to Improve the Operating Cycle?

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Upgrade to one of our premium templates when needed and take your work to the next level.

Days Sales of Inventory (DSI)

A manufacturer’s operating cycle might start when the company spends money on raw manufacturing materials to make a product. The operating cycle wouldn’t end until the products are produced and sold to retailers or wholesalers. By implementing these best practices, you can significantly reduce your Days Sales Outstanding (DSO) and expedite the cash collection process, thereby shortening your operating cycle and enhancing your financial stability. Inventory management is a crucial component of your operating cycle, as it directly impacts how efficiently you can turn your investments in goods and materials into cash. By carefully controlling your inventory, you can reduce carrying costs, minimize the risk of obsolescence, and ensure that you have the right products available to meet customer demand.

Financial Modeling Solutions

To improve your DSI, consider implementing inventory optimization techniques, such as demand forecasting, JIT inventory management, and safety stock management, as discussed earlier in this guide. Let’s dive deeper into practical applications and examples to illustrate how the operating cycle formula works. If that is the case, then the operating cycle would be from when cash was outlaid to pay whatever expenses were needed to get the next service up and running to when the cash was ultimately collected for that service. The operating cycle is equal to the sum of DIO and DSO, which comes out to 150 days in our modeling exercise. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – from 11 Financial upon written request.

A longer DPO indicates that you are retaining cash for a more extended period, which can be advantageous for working capital management. Days Sales Outstanding (DSO) measures the average number of days it takes for your company to collect payments from customers after making a sale. A lower DSO indicates operating cycle that you are collecting payments promptly, which positively impacts cash flow and liquidity. Managing your accounts payable efficiently is equally important in optimizing your operating cycle. By extending payment terms without straining vendor relationships, you can retain cash for a longer duration.

Our McKinsey survey revealed that model development and validation teams face peak workloads due to these challenges, along with keeping pace with business-as-usual activities. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. They also make large quantities of these items and have little to no inventory to maintain. For example, take a look at retailers like Wal-Mart and Costco, which can turn their entire inventory over nearly five times during the year.

Do you already work with a financial advisor?

This can keep you updated on the efficiency of your inventory process, which provides insights time and again to help you reduce wastage and improve your overall processes. Managing your operating cycle efficiently often requires the right tools and software to streamline processes, monitor key performance indicators, and make informed decisions. We will explore essential tools and software that can help you effectively manage and optimize your operating cycle. Now that you have a solid understanding of the operating cycle and how to calculate it, let’s explore practical strategies that can help you optimize and enhance the efficiency of your operating cycle.